Reading Time: 4 Minutes

Summary: Scaling a real estate portfolio requires more than just capital—it requires the right partnerships and a clear "why." At the recent Portland REI meetup, guest speaker Jason James shared his journey from the 9-5 grind to a multi-state portfolio.

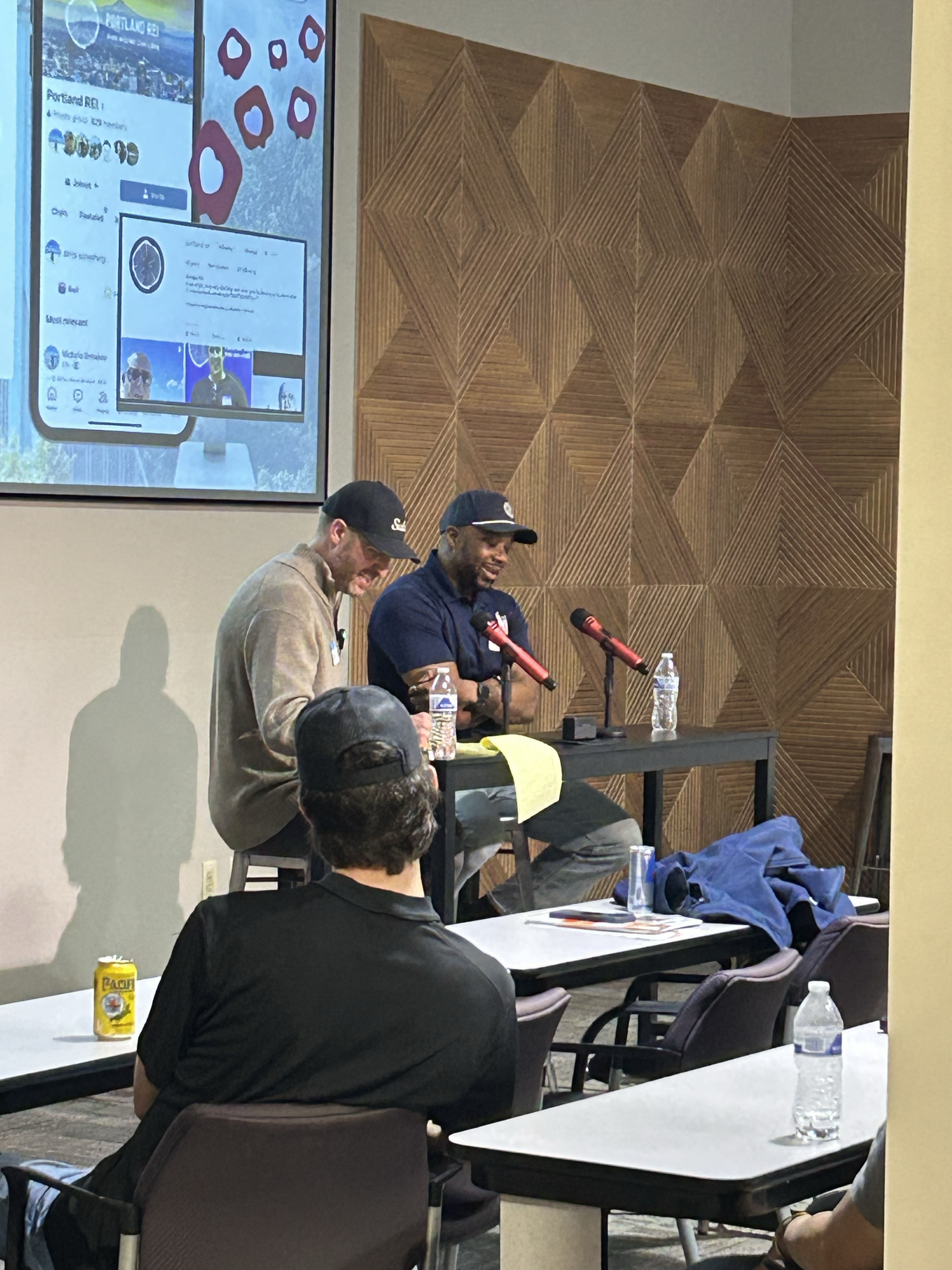

Values, Vision, and the Vault: A Recap of the Portland REI January Meetup

Real estate investing is often discussed in spreadsheets and cap rates, but the January Portland REI meetup proved that the "human" element is what truly dictates a portfolio's ceiling.

The evening began with a high-energy welcome from Chris Merz, who greeted the ~35 attendees. The atmosphere was focused and collaborative—a room full of practitioners looking to move beyond the theoretical.

The Partner Filter: Identifying the "Red Flags"

Before diving into the main interview, the room engaged in a tactical networking exercise centered on a critical question: "What makes a bad partner?"

In an industry where high-level delegation and joint ventures are the keys to scaling, understanding who not to work with is as important as finding the right deal. The consensus from the room was clear: a lack of transparency, misaligned values, and undefined KPI's are the fastest ways to sink a business enterprise.

Jason James: From the 9-5 to Multi-State Freedom

While Chris Merz had to excuse himself early in the evening, the transition was seamless. His partner stepped in to lead a deep-dive interview with Jason James, owner of That 1 Painter and a seasoned investor with doors in California, Michigan, Illinois, and Missouri.

The conversation moved past the "how-to" and into the "why." Jason shared how his upbringing and early experiences shaped his drive to escape the traditional 9-5 structure. For Jason, real estate wasn't just about the cash flow; it was about reclaiming time and building a legacy that aligned with his core values.

Key Insights from Jason's Journey:

Scaling Remotely: You don't have to live where you invest. Jason has mastered the art of managing acquisitions and rehabs from thousands of miles away by leveraging systems and local "boots on the ground."

The "Painter" Mentality: Running a service business and a real estate portfolio requires the same foundation: high-quality systems and a team you can trust.

Value-Driven Investing: Your drive to succeed is only as strong as the values behind it. When your "why" is rooted in family and freedom, the hurdles of out-of-state investing become manageable.

The Bottom Line

Whether you are house hacking in Portland or BRRRR-ing in the Midwest, the takeaway from this month’s meetup was simple: Systems run the business, but values run the systems.