The Homeowner’s Financial Guide to Converting a Primary Residence into a Rental

Moving out of your first home is a major milestone, but selling it isn’t your only option. For many homeowners in the 35–45 age bracket, the "Keep and Buy" strategy is the fastest way to build long-term wealth. Instead of taking a one-time check from a sale, you can transform your current home into a cash-flowing engine that helps fund your next property.

But does the math actually work—especially with Portland's unique regulations? Let’s break down the financial pillars of turning your home into an investment.

1. The Math of Passive Income: Will Your Home Pay for Itself?

Before you put a "For Rent" sign in the yard, you need to move beyond "guessing" what your profit will be. Real estate professionals use a specific formula to determine if a property is a viable rental.

The Cash Flow Formula:

Monthly Rent – (Mortgage + Taxes + Insurance + Maintenance + Vacancy) = Net Cash Flow

The 1% Rule: A quick (though aggressive) benchmark. If your home is worth $400,000, does it rent for $4,000? In Portland’s 2026 market, this is difficult to hit, so you must focus on your Net Operating Income (NOI).

CapEx Reserves: Set aside 5–10% of monthly rent for big-ticket items like roof repairs or water heaters. You don't want a broken appliance to wipe out your yearly profit.

2. Financing the Leap: Buying the Next Home

The biggest hurdle "Harry the Homeowner" faces is qualifying for two mortgages at once. You do not always need to pay off your first house to buy a second.

Lenders often allow you to use 75% of your projected rental income to offset your current mortgage payment. This lowers your Debt-to-Income (DTI) ratio, making it possible to qualify for that new, larger home for your family.

Common Funding Strategies:

HELOC (Home Equity Line of Credit): Draw against the equity in your current Portland home to fund the down payment on the next.

Bridge Loans: Short-term financing to cover the gap between properties.

3. The Portland Factor: Local Realities for 2026

If your home is within Portland city limits, the financial math is governed by specific local laws. To protect your ROI, you must account for these three factors:

The 9.5% Rent Cap: For 2026, the State of Oregon has capped rent increases at 9.5% for most homes older than 15 years. You cannot exceed this, even if market demand suggests a higher price.

Relocation Assistance Protection: Portland requires landlords to pay tenants a relocation fee (currently $4,500 for a 3-bedroom home) if you raise the rent by 10% or more, or issue a "no-cause" notice.

The "Harry" Fix: You can apply for a "Temporary Rental of a Principal Residence" exemption if you plan to rent your home for 3 years or less. You must file this with the Portland Housing Bureau before the lease is signed to avoid this $4,500 liability.

Mandatory Registration: You must register your rental unit annually with the City of Portland Revenue Division. The fee is approximately $70 per unit, and failing to register can lead to penalties that equal 100% of the fee.

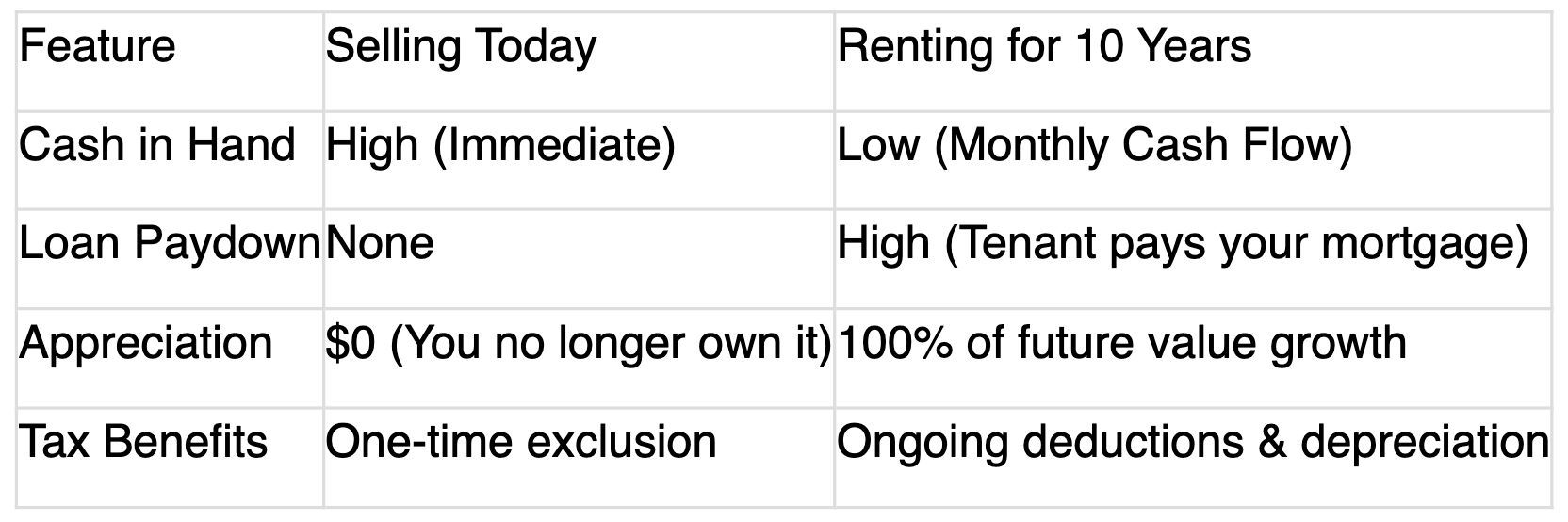

4. Selling vs. Renting: The 10-Year Wealth Gap

5. 3 Signs You’re Ready to Become a Landlord

Your Mortgage Rate is Low: If you have a "unicorn" interest rate (sub-5%), that cheap debt is your biggest competitive advantage.

You Have an Emergency Fund: You can handle a 2-month vacancy or a surprise plumbing repair without financial panic.

You Value Equity Over Quick Cash: You’re playing the long game for retirement, not looking for a one-time payday.

Take the Next Step

Calculations are the foundation of your success. To help you get started, we’ve built a Portland-Specific ROI Calculator that accounts for local taxes and registration fees.

Click here to use the ROI Calculator