While the debate between the stock market and real estate investment has been reining forever, understanding which is better will require a quick look over historical data that contains information on the past performance of the two investments. There are three key strategies adopted when looking to invest in both the stock market and in real estate. They include the Long Only, Alpha Capture, and Distressed. However, for the purpose of this article, our focus shall remain glued to the Long Only strategy.

The long-only strategy involves the acquisition of investment for the sole purpose of holding. In this case, an example of a real estate investment would include acquisition of property and renting it out while an investment in the stock market would include the purchase of something like the S&P 500 index.

Past performance

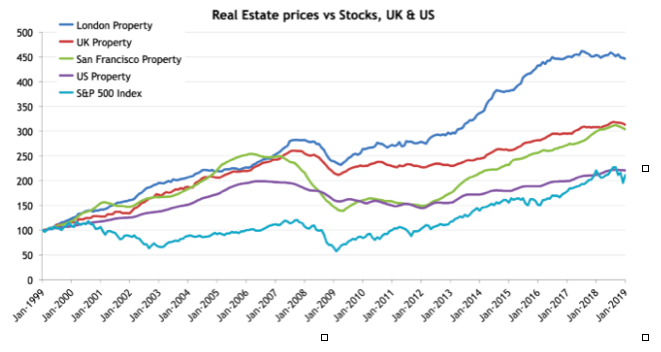

A comparison of the real estate and the stock exchange market will show how the real estate sector has been performing well over the years when compared to the stock market.

(Price action history, Stock vs real estate)

The graph above shows a huge performance difference between real estate and the stock market. When comparing real estate performance to that of a financial instrument such as the S&P 500, you will note that real estate has over the years, performed better by far with the London real estate market being the best performer. Much as past performance cannot guarantee future performance, it goes far to show you how reliable the real estate is when compared to the stock market in terms of performance.

Fair value today

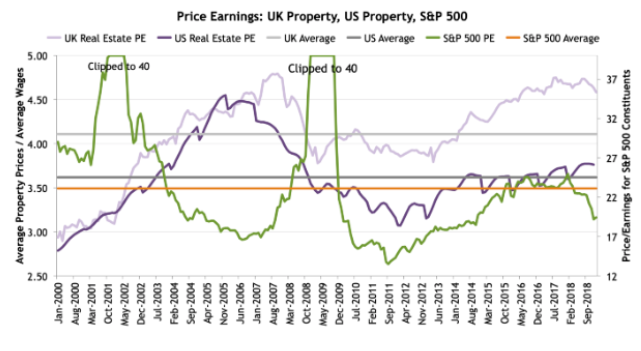

Both the stock market and real estate investments experience some elasticity to existing variations. For example, the average salary of people in an area will be a key determinant of the property prices in an area. However, this balance can be undone by speculative demand, thereby shifting the demand-supply equilibrium. The stock market, on the other hand, has its prices determined by forward expected earnings. The new money that will be directed to a particular asset class creating an imbalance of the supply and demand, thereby pushing the price up or down. Such imbalances are what causes the depressions and bubbles in the economy.

From the provided graph, it is key to note that the stock market has maintained its price earning below that of their historical price/earnings average. The real estate market, on the other hand, has posted a higher price earning in comparison to its historical Price/earnings average.

Much as this shows that the stock market is a somewhat cheaper investment, the real estate market continues to show continuous growth and performance by surpassing its historical price/earnings average.

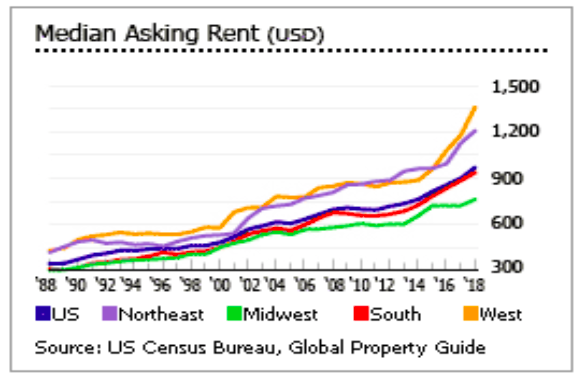

Growing rent

Rising rents postulate increased returns to the real estate investors that choose to let out their property. This shows a huge potential for increased earnings, thereby making the real estate investment much preferable than the stock exchange. The US rental prices have shown a sustained increase of 10% on year to year basis, with the median monthly rent for 2018 in Q3 was around $1,003

(Asking rent/year)